Best AI Receptionist for Insurance Agents (2025)

Stop losing insurance leads to missed calls. See how AI receptionists handle quotes, claims, and emergencies while saving agents 58+ hours monthly.

November 7, 2025

Insurance agencies live and die by phone calls. Whether it's a new policy inquiry, a client filing a claim, or an after-hours emergency, every ring matters.

Yet nearly 40% of calls to insurance companies go unanswered, and about 85% of people whose call isn't answered will never call back (according to research from Cymphony on missed calls in financial services).

The numbers get worse. 78% of insurance shoppers call an agent after an online search, which means every missed call is a lost opportunity. In dollar terms, the average business might lose over $120,000 in revenue annually due to missed calls and voicemail.

An AI receptionist can be the solution that ensures no call slips through the cracks and that your agency is always "open" 24/7 for customers. In this comprehensive guide, we'll explore why AI receptionists are becoming essential for insurance agents, what features to look for, and how to choose the right solution for your agency in 2025.

Why Do Insurance Agents Need AI Receptionists?#

How AI Stops Missed Calls and Voicemail Problems#

An AI receptionist answers every inbound call, 24/7/365. Clients never hit voicemail or give up in frustration.

Unlike a human who clocks out at 5 pm, AI is always on duty.

This is crucial in insurance, where customers might have an accident or urgent question at any hour. With an AI handling after-hours calls and overflow calls, agencies can capture 100% of after-hours leads without needing on-call staff. The result is not just fewer missed opportunities, but also higher customer trust (knowing someone is always there for them).

How Fast AI Response Times Improve Client Satisfaction#

Time is money in insurance, and clients expect quick answers (especially in emergencies). AI receptionists can handle multiple calls simultaneously with no hold times, reducing wait times and improving satisfaction.

Routine questions like "What's my deductible?" get instant answers, freeing your licensed agents to focus on complex issues.

By immediately addressing common inquiries, AI receptionists help resolve issues faster and increase customer satisfaction. Insurers using AI for customer service have seen customer satisfaction scores increase by as much as 25% on average in some studies.

24/7 Emergency Claims Handling with AI Receptionists#

Insurance clients often have urgent needs outside normal business hours. A late-night call about a car accident or a weekend inquiry about a flooded basement can't wait until Monday.

AI receptionists provide round-the-clock support. Even at 3 AM, your customer hears a friendly voice ready to help.

They can triage emergency claims by verifying a policy and detecting keywords like "my house is flooding" to instantly route the call to your on-call adjuster. Less critical issues are calmly handled or scheduled for follow-up, ensuring critical claims get immediate attention while you sleep.

How to Capture Every Lead Before Competitors Do#

In insurance sales, speed to lead is crucial.

If a prospect's call isn't answered, they'll likely dial the next agent on Google. AI receptionists excel at instant lead capture. They answer on the first ring, collect the caller's name, contact, and insurance needs, and even book an appointment or callback.

This means even if you're busy or after hours, the AI has engaged the prospect and locked in a follow-up rather than sending them to a rival.

AI phone agents can significantly cut call abandonment rates and increase new policy quotes by ensuring every caller receives immediate engagement.

The bottom line? An AI receptionist makes sure a potential policyholder never hears silence or a voicemail. Instead, they get service and you get their info in real time.

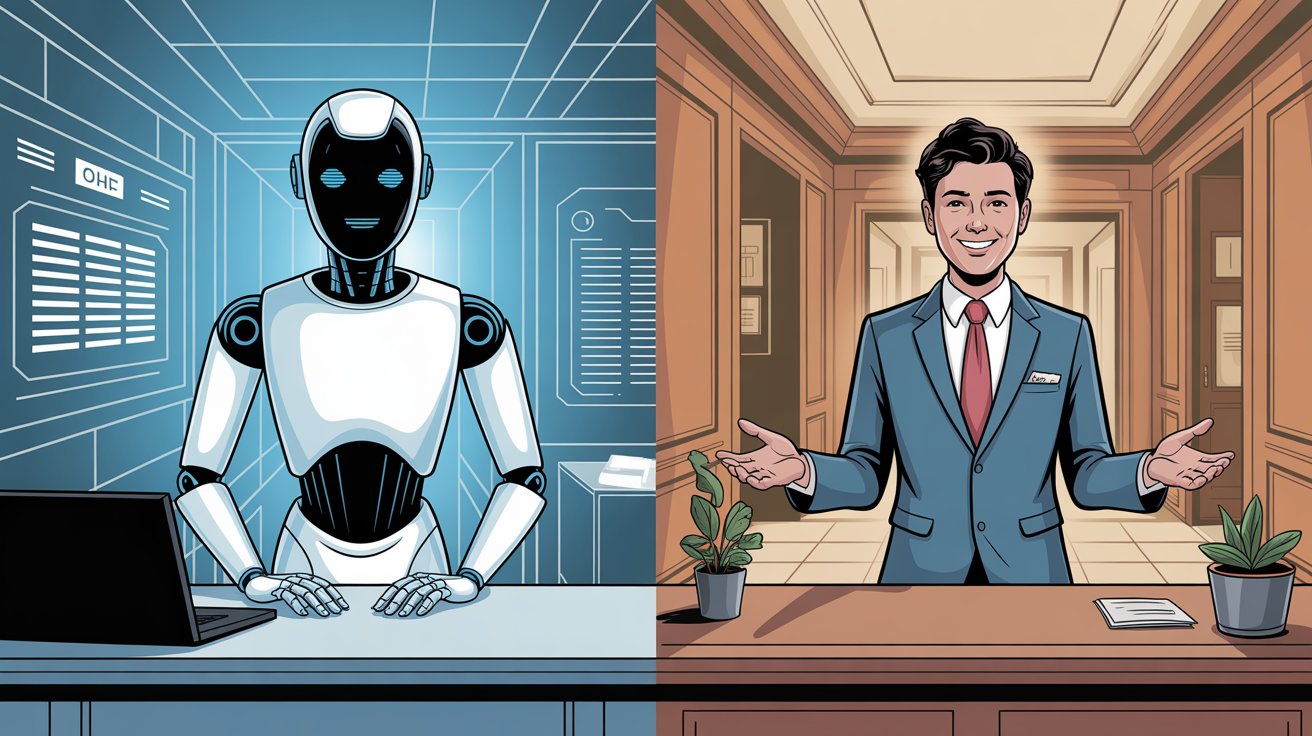

AI Receptionist Cost Savings vs Human Staff#

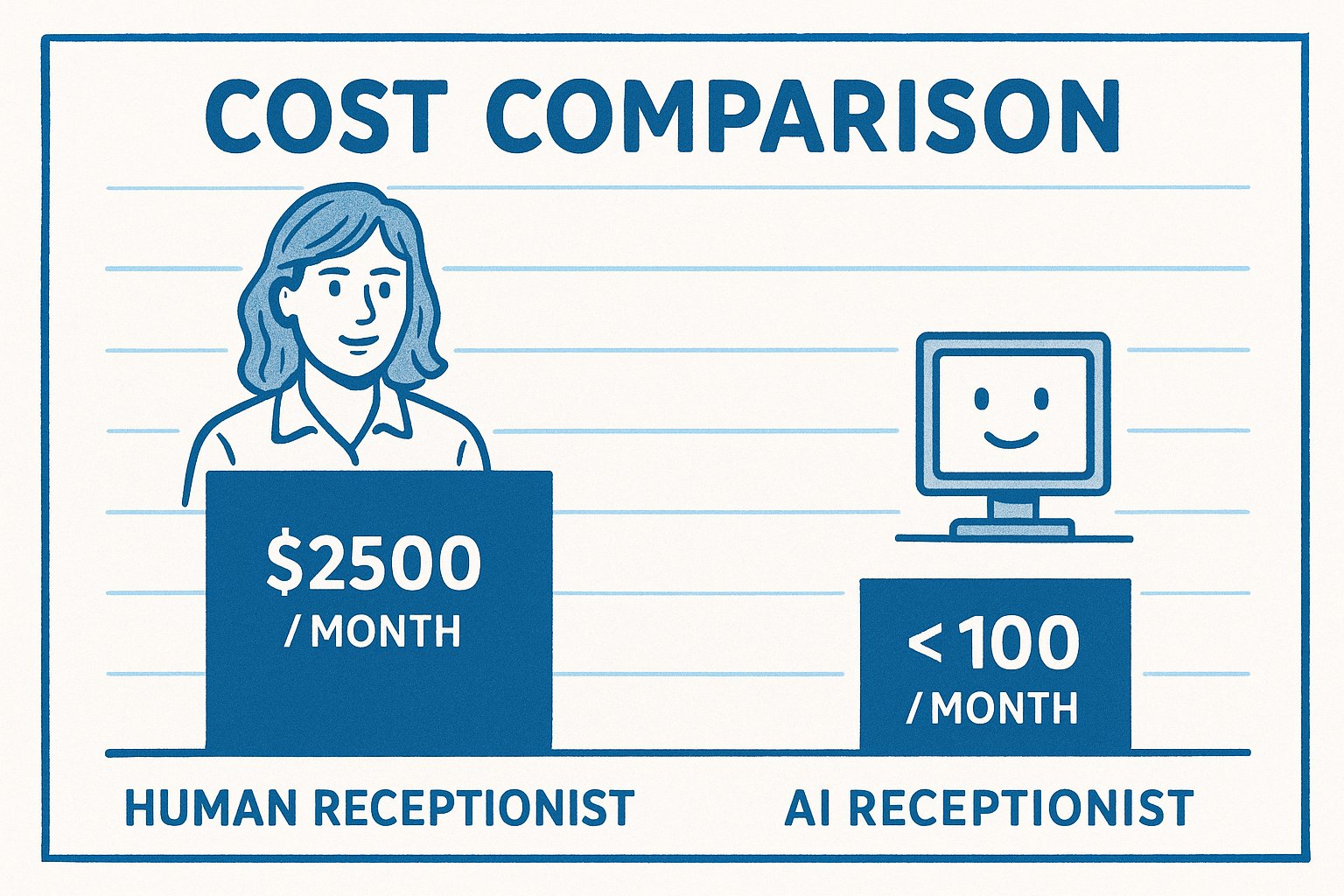

Compared to hiring full-time staff or contracting a human answering service, AI receptionists are extremely cost-effective.

Many services cost a flat monthly fee or a low per-minute rate, translating to hundreds of dollars saved each month in labor costs. Instead of paying a receptionist $2,500+ a month, an AI answering service might cost under $100 for unlimited calls.

They're also highly efficient (able to handle many calls at once without needing coffee breaks or overtime). Small agencies with tight budgets especially benefit: they get professional call handling for a fraction of the cost of a human.

And unlike a person, AI doesn't make mistakes or forget details.

Every call is logged, transcribed, and summarized for you automatically.

What Features Should Insurance AI Receptionists Have?#

Not all AI receptionists are created equal. When evaluating the best solution for an insurance agency, look for features and capabilities that align with the unique needs of your business.

Insurance-Specific AI Training and Terminology#

The AI should understand common insurance terminology like premium, deductible, claim, policy, endorsement, binder and the typical questions clients ask.

Insurance calls can be nuanced, so the system must be trained on insurance-specific scenarios. For example, if a caller says "I need to add a new car to my policy," the AI should recognize this as a policy change request.

Many top providers let you import your FAQs and scripts so the AI is fluent in your products and processes from day one.

24/7 Call Answering with Smart Call Routing#

Always-on availability is non-negotiable.

Beyond that, look for intelligent call routing capabilities. The best systems can automatically classify call types and route or escalate appropriately.

For instance, if a caller says "I had a car accident" with urgency in their voice, the AI can recognize an emergency claim scenario and warm-transfer the call to your emergency line or on-call agent. On the other hand, a routine quote inquiry can be handled fully by the AI or scheduled for a next-day follow-up.

Advanced systems even detect caller sentiment or stress in voice (hearing frustration or fear) and will offer to hand off to a human for the personal touch.

Natural Conversation AI with Human-Like Voice#

Choose a solution with strong Natural Language Processing (NLP) so it can truly understand callers and respond naturally.

The more human-like the voice and conversational ability, the better the customer experience. Modern AI receptionists use polished text-to-speech voices that sound warm and clear (not robotic).

They can handle when callers go off-script or ask follow-up questions. Crucially, they should handle free-form input. For example, if you ask "How can I help you today?" the caller might tell a whole story. A good AI can parse the intent from a long response.

Emotional intelligence is a plus: some AIs can detect anger or confusion and adapt their responses or promptly involve a human.

Automated Appointment Scheduling and Follow-Up#

One of the best ways an AI receptionist can convert calls to customers is by scheduling appointments or callbacks on the spot.

Look for appointment scheduling integration with calendars (Google, Outlook, etc.) so the AI can offer available meeting times or book a phone appointment for a prospect to speak with an agent.

Some systems will even send a confirmation text or email to the caller with the appointment details (a professional touch). And if the caller prefers self-service, certain AI receptionists can text them a secure link to schedule at their convenience.

CRM and Agency Management System Integration#

Your AI receptionist shouldn't be a standalone island.

The best solutions integrate with your Agency Management System (AMS) or CRM to pull and push data. For example, when an existing client calls, the AI could look up their name or policy number in your database to personalize the interaction ("I see you have two cars insured with us, are you calling about the Honda or the Ford?").

On the backend, integration means call details, transcripts, and new lead info captured by the AI are automatically logged in your system (no manual data entry).

At minimum, look for Zapier or API integration options so you can connect call data to your management software, email marketing, and other tools.

Customizable Call Scripts and FAQ Database#

Customization is key.

You should be able to configure what your AI says and how it behaves. The best platforms let you easily edit the greeting, caller questions, and decision trees without needing a programmer.

For instance, you might script a specific process for quote calls:

① Greet the caller by name

② Ask what type of insurance they need

③ Collect basic info

④ Either warm-transfer to a sales agent if one is free or schedule a callback

Also look for the ability to add your own FAQ knowledge base (upload common Q&A about your policies). This will enable the AI to answer specific questions ("What does my homeowners policy cover if my basement floods?") accurately from your provided info.

Multi-Channel Communication and Bilingual Support#

Phone calls are priority, but many AI receptionist services now offer omnichannel capabilities (handling not just calls, but also texts/SMS, web chat, or Facebook messages in one system).

If your agency gets a lot of queries through those channels, an AI that can manage them is valuable. Bilingual support is another big plus in insurance (especially Spanish in the U.S.).

Some AI receptionists can fluidly switch languages when needed.

If you serve a diverse client base, having an AI receptionist that "habla Español" could set you apart without requiring hiring bilingual staff.

Insurance Compliance and Data Security#

Insurance data is sensitive, so pay attention to how the AI service handles privacy and compliance.

Verify that call recordings and data are stored securely (SOC 2, HIPAA compliance if health-related insurance, etc.). The system should allow custom legal disclaimers to be played if required in your state (for example, some states require informing callers that a call is being recorded).

Also, check that you can easily access and download call transcripts/recordings for your records.

Call Analytics and Performance Insights#

One underrated benefit of AI receptionists is the rich call data they can provide.

Look for a dashboard or reports that show you metrics like:

→ Call volume by hour

→ Common call topics or keywords

→ Average call duration

→ Customer sentiment trends

The AI is transcribing every call, so some platforms even use that to analyze customer sentiment or trending issues.

Real-time notifications are also important: you should get instant alerts (via email/SMS or mobile app) for critical events, like when the AI marks a call as a hot lead or when a call is transferred to an agent.

Essentially, the AI receptionist shouldn't just handle calls (it should help you understand your calls and improve your service continuously).

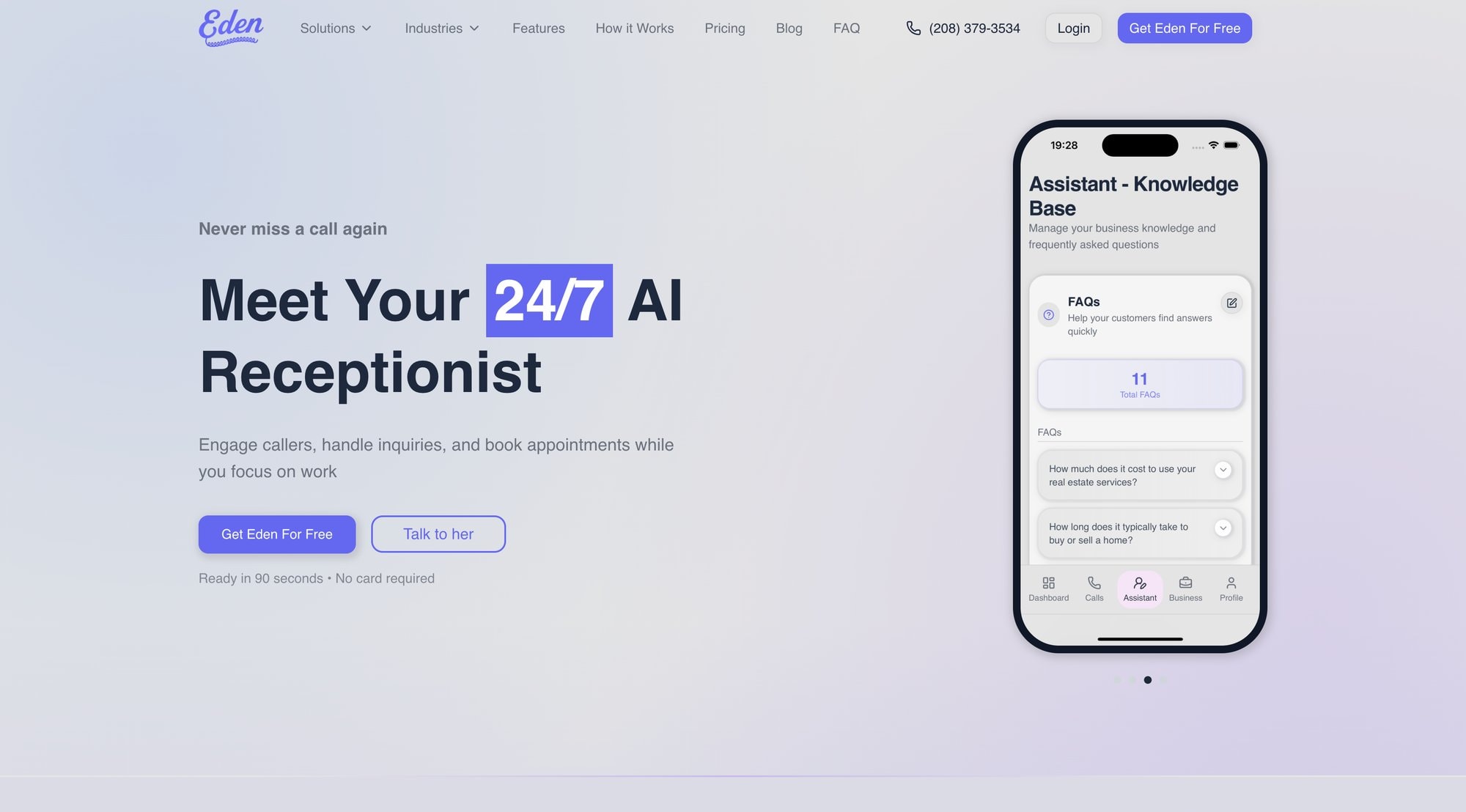

Best AI Receptionist for Insurance: Why Eden Leads#

When it comes to AI receptionists specifically built for insurance agencies, Eden stands out as the best overall choice for most small-to-midsize independent agencies in 2025.

Insurance-Specific Features and Scripts#

Eden comes with insurance-specific skills and scripts out of the box.

It knows how to handle quote calls vs. claim calls vs. policy service calls differently. Eden can capture quote requests after hours by collecting the prospect's info and coverage needs, then emailing or texting you a summary.

During high-volume times (say a storm rolls through and many clients call with claims), Eden can act as a first-line triage by collecting initial claim details and identifying urgent cases (like keywords "flood" or "fire") to immediately notify or transfer to your on-call staff.

Meanwhile, non-urgent claims can be scheduled for follow-up, easing the pressure on your team.

How Eden Captures Every Insurance Lead#

Eden excels at instant lead capture.

When a prospect calls after hours about getting a quote, Eden answers immediately: "Thank you for calling, this is Eden. How can I help?"

The AI gathers the necessary information (coverage type, basic details) and either emails the details to you to process first thing or even offers to schedule a call with you. The client hangs up feeling heard and helped (without talking to a human at that moment).

If the call is a claim ("I had a fender bender"), Eden would pull the policy info, start the claim intake process, and if the customer is upset or the situation is urgent, Eden might say "I'm connecting you to our on-call representative now" (executing a warm transfer to your cell).

In both cases, you later see a full transcript and summary of the call in your dashboard or email.

No voicemails, no phone tag, and no lost customer.

English and Spanish Bilingual AI Support#

Another big plus is Eden's bilingual ability.

It offers bilingual voice support (English and Spanish) with a very natural voice, seamlessly switching between languages as needed. If you serve Spanish-speaking clients, Eden has you covered without hiring additional bilingual staff.

IntelliSpam Call Filtering Technology#

Eden features advanced spam call filtering (IntelliSpam) to block robocalls and telemarketers that often target insurance agencies.

This means your line stays free for real customers, and you're not wasting AI minutes on spam.

Google and Outlook Calendar Integration#

Eden integrates with Google and Outlook calendars for appointment scheduling.

It can send callers a texted scheduling link and syncs with CRMs via Zapier or API. Every call is recorded and transcribed, with instant summaries sent to you by SMS/email after each call.

Affordable Pricing for Insurance Agencies#

Eden's pricing is small-business-friendly:

| Plan | Price | Minutes | Best For |

|---|---|---|---|

| Plus | $39/month | 200 minutes | Solo agents or very small teams |

| Pro | $99/month | Unlimited | Busy agencies that want booking & transfers |

All plans include core features like 24/7 answering, call recordings, and basic customization. Pro adds things like multiple AI voice options, advanced call transfer logic, and API access.

Notably, Eden's unlimited minutes on Pro can be a huge cost saver for agencies with lots of calls (competitors often charge per minute overages).

There's no long contract (it's month-to-month with the option to cancel anytime).

Real Insurance Agency Results with Eden#

To illustrate Eden's value, imagine an independent insurance broker before Eden: if a client called at 7pm Friday about adding a newly purchased car, they'd hit voicemail and maybe hang up.

With Eden, the call is answered immediately. The client says they bought a car. Eden gathers the necessary info (make, model, etc.) and either emails the details to the agent to process first thing Monday or even offers to schedule a call with the agent Monday morning.

The client hangs up feeling heard and helped without talking to a human at that moment.

This is how Eden ensures every caller gets immediate, professional service (day or night). It essentially gives even a 2-person agency the phone capabilities of a much larger firm.

Why insurance agents choose Eden: "Insurance agencies lose critical leads when calls go to voicemail or get missed during busy hours. Eden ensures every caller gets immediate, intelligent service 24/7, so agents can focus on closing deals, not answering phones." (Eden's insurance answering service page)

Ready to never miss another call? Start your free trial with Eden today and see the difference 24/7 AI answering can make for your insurance agency.

How to Get Maximum ROI from Your AI Receptionist#

Choosing the right AI receptionist is a big step, but success also depends on how you implement and use it. Here are a few tips to ensure you get a strong ROI and a smoother experience:

How to Customize AI for Your Insurance Agency#

Spend time up front to feed it your key information (business hours, the carriers or products you offer, your team contacts for transfers, etc.).

Write a warm greeting message that fits your style ("Thank you for calling Acme Insurance, how can I assist you today?"). If possible, upload FAQs or knowledge base docs so the AI has a wealth of accurate info to pull from.

The more you teach the AI about your business, the better it will perform.

Treat it like onboarding a new employee (initial training is crucial).

How to Phase in AI Receptionist Features#

It can be tempting to let the AI handle everything out of the gate. A smarter approach is to start with a couple of call types or tasks, and then expand.

For example, maybe start by having the AI handle after-hours calls and simple inquiries during work hours. Get comfortable with those interactions (review transcripts, see how it does), then add more duties like taking claims info or making reminder calls.

Iterate and refine (most platforms let you adjust scripts or add new Q&A based on real calls).

How to Use Call Data to Improve Performance#

Make use of the transcripts and analytics.

They can reveal customer needs or bottlenecks. If you notice callers keep asking a question the AI can't answer, that's an opportunity to update the AI's knowledge (or realize you might need to proactively inform clients on that issue).

Keep an eye on any failure points (if the AI frequently has to transfer certain types of calls, maybe script a better response or decide those should directly go to a person).

By actively managing the AI, you'll continuously improve your workflow efficiency.

How to Train Your Team to Work with AI#

Let your staff know how the AI works and how it benefits them (it's not there to replace them, but to offload the boring stuff and ensure they get qualified callers).

Train them on how to handle transfers from the AI or how to use the dashboard to see call summaries. Encourage them to give feedback.

For instance, if your producer notices the AI is giving a weird answer about coverage, they should flag it so you can correct that info.

By treating the AI as part of the team, you'll get better adoption.

How to Track AI Receptionist ROI Metrics#

Track metrics like:

• How many calls the AI is handling

• Reduction in voicemail usage

• How many leads it captures per month

• Customer feedback on service quality

You might find that in the first month it handled 120 calls, of which 30 were new prospects (resulting in 10 new policies).

Or that it freed your account manager from answering 15 mundane calls a week, giving her more time to do cross-selling.

Quantifying these outcomes helps you see the value and also identify areas to adjust.

AI Receptionist FAQs for Insurance Agencies#

How much does an AI receptionist cost for an insurance agency?#

AI receptionist pricing varies by provider and features.

Most services range from $39 to $300 per month depending on call volume and capabilities. For example, Eden offers plans starting at $39/month for 200 minutes (Plus plan), $99/month for unlimited minutes (Pro plan).

This is significantly cheaper than hiring a full-time receptionist ($2,500+ monthly) or using human answering services (often $150-$300 for just 50-100 minutes of calls).

Can an AI receptionist handle complex insurance questions?#

AI receptionists excel at handling routine inquiries (policy details, coverage questions, billing, ID card requests, etc.).

For complex questions or situations requiring licensed agent judgment, the best AI systems know their limits. They can intelligently escalate to a human agent when needed.

Advanced systems like Eden can detect urgency or complexity in a caller's tone and seamlessly transfer to your team while providing full context from the conversation.

Will clients know they're talking to an AI?#

Modern AI receptionists sound remarkably human.

Many callers won't realize they're speaking with AI unless the conversation gets very complex. You have a choice whether to explicitly identify the AI ("This is Eden, the virtual assistant") or simply let it introduce itself by name.

Some agencies prefer transparency, while others find clients simply appreciate the fast, helpful service regardless.

The key is ensuring the AI provides excellent customer service (which most callers value more than whether it's human or AI).

How long does it take to set up an AI receptionist?#

Most AI receptionist services offer quick setup.

Eden, for example, can be live in about five minutes. You'll typically need to:

• Provide your website or business information

• Configure your greeting and basic scripts

• Set up call forwarding from your existing number

• Test the system with a few calls

Some insurance-specific platforms might take 1-2 weeks for deeper integration with your Agency Management System, but the tradeoff is more customization.

Can an AI receptionist integrate with my Agency Management System (AMS)?#

Many AI receptionists offer integration capabilities.

Eden integrates with popular calendars (Google, Outlook) and CRMs via Zapier or API connections. More specialized insurance platforms offer deeper AMS integration (pulling client data in real-time during calls).

Integration allows the AI to:

• Access client information to personalize interactions

• Automatically log call notes and data

• Schedule appointments directly into your calendar

• Update policy information or claim details

What happens if the AI can't handle a call?#

The best AI receptionists are programmed to recognize when they need human help.

They can:

• Transfer calls to your team (warm transfer with context)

• Take detailed messages with full transcripts for callback

• Schedule appointments for a human agent to follow up

• Escalate based on sentiment (if a caller sounds frustrated or the situation is urgent)

Eden, for example, can intelligently route emergency claims to your on-call agent while handling routine inquiries independently.

Is an AI receptionist compliant with insurance regulations?#

Reputable AI receptionist services are designed with compliance in mind.

They can:

• Play required disclaimers (call recording notices, license numbers)

• Maintain complete transcripts and recordings for E&O protection

• Store data securely (SOC 2 compliance, encryption)

• Follow your scripts exactly to ensure regulatory compliance

However, you remain responsible for ensuring your use complies with state insurance regulations.

Review your AI's scripts with your compliance team and ensure any required disclosures are included.

Can an AI receptionist handle bilingual calls?#

Many modern AI receptionists offer bilingual support (typically English and Spanish).

Eden, for instance, can automatically detect the caller's language and respond in either English or Spanish with a native-quality bilingual voice.

This is especially valuable for insurance agencies serving diverse communities, as it eliminates the need to hire bilingual staff while still providing excellent service to Spanish-speaking clients.

How does an AI receptionist handle after-hours emergency calls?#

AI receptionists are ideal for after-hours coverage.

For insurance agencies, they can:

• Triage emergency claims by identifying urgent keywords ("accident," "fire," "flood")

• Collect critical information (policy number, nature of emergency, contact details)

• Immediately notify on-call staff via text or warm transfer

• Provide reassurance to stressed callers while connecting them with help

• Schedule non-urgent callbacks for the next business day

Eden specifically offers claims emergency routing that can detect urgency and immediately connect critical calls to your on-call agent.

What's the ROI of an AI receptionist for insurance agencies?#

The ROI typically comes from three main sources:

① Captured leads: Stop losing prospects who hang up when they reach voicemail. Learn about revenue lost from unanswered calls.

② Staff efficiency: Free your licensed agents from routine calls. Some agencies report reclaiming 2+ hours per day per agent.

③ Cost savings: Avoid hiring additional staff ($2,500+/month) by handling call volume with AI ($39-$300/month).

If you're missing even 5-10 calls per week that could become clients, the ROI from capturing those leads alone typically pays for an AI receptionist many times over.

Ready to transform your insurance agency's phone handling? Try Eden free for 7 days and experience the difference 24/7 AI answering makes.

The best AI receptionist for an insurance agent is the one that fits your agency's size, budget, and way of working.

We've entered an era where even the smallest insurance offices can afford a 24/7 virtual staff member. Insurance is a business built on trust and availability.

An AI receptionist like Eden helps you be available and responsive at all times, in a consistent and cost-effective way.

It's like adding a superpowered receptionist who never sleeps, never takes a holiday, and never gets flustered (all for a tiny fraction of the cost of an employee).

From capturing that late-night lead who Googled "best insurance agent near me" to reassuring a panicked client when a disaster strikes, Eden has got your back.

Get started with Eden today and never miss another call or customer again.

Ready to Transform YourCustomer Experience?

Join hundreds of businesses using Eden AI to handle calls, book appointments, and provide 24/7 customer support.