Accounting Answering Service: Complete Guide (2026)

Never miss another accounting lead. Compare AI vs live answering services for CPAs, plus pricing, features, and setup guides for busy tax season coverage.

December 20, 2025

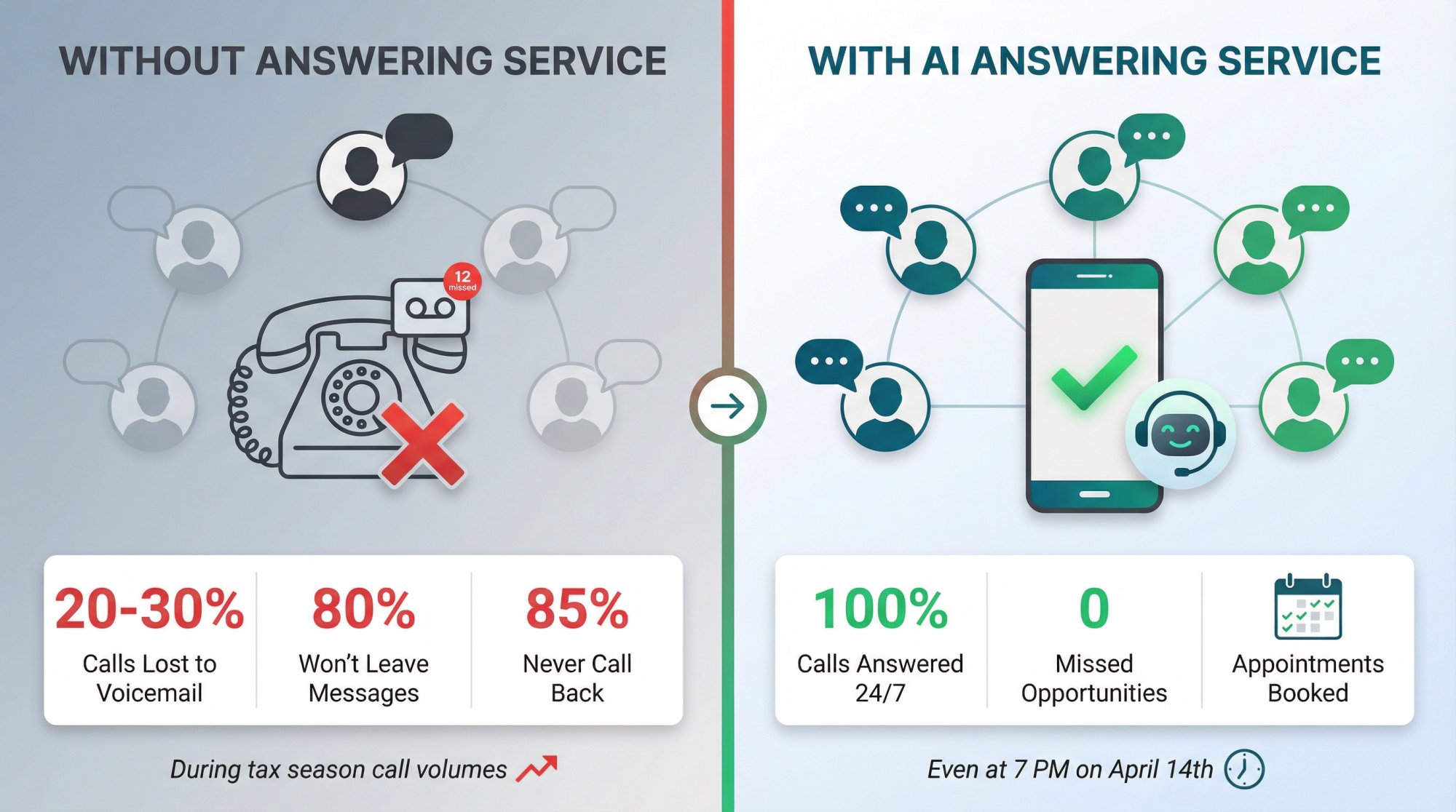

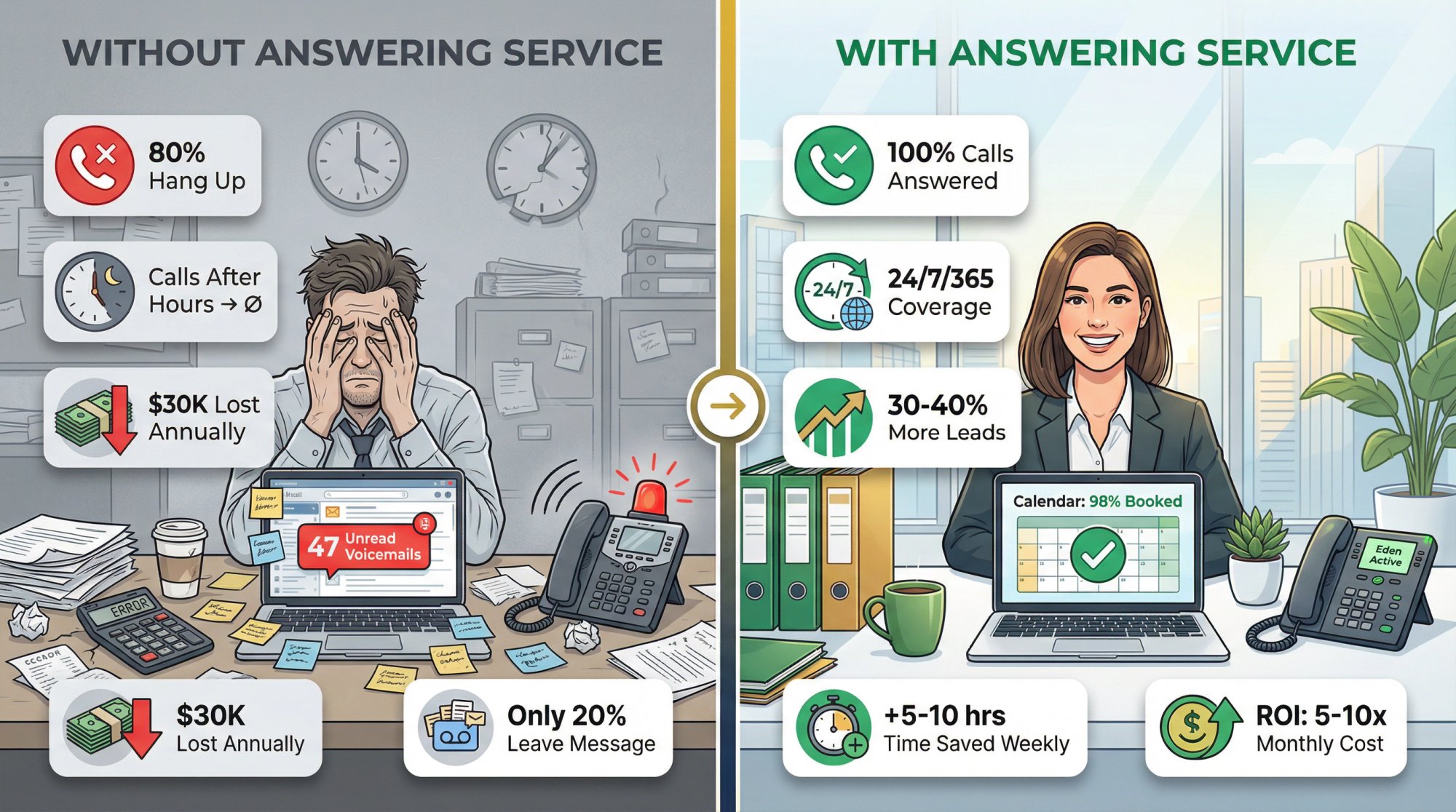

Missing calls during tax season could be costing you more than you think. Research shows that CPA firms lose 20-30% of incoming calls to voicemail when things get busy. The real problem? About 80% of callers hang up if they hit voicemail. They're not leaving a message. They're calling the next accounting firm on Google.

Every unanswered call could be a tax prep client, a bookkeeping contract, or a consultation worth thousands. And it's not just about the money you're losing. It's about the impression you're making.

An accounting answering service ensures every call gets answered professionally, 24/7, so you never miss a lead (even at 7 PM on April 14th).

In this guide, we'll cover everything accountants need to know about answering services. What they actually do, why they matter for your firm, the features worth paying for, and how modern AI solutions stack up against traditional options.

By the end, you'll understand how the right answering service can capture more leads, improve client relationships, and free up hours of your time each week.

What Is an Accounting Answering Service?#

Think of it as having a virtual receptionist who never takes a break. When your phone rings, a professional service picks up in your company's name and handles the caller's needs. No more voicemail. No more missed opportunities.

But these services do way more than take messages:

→ 24/7 Live Coverage

Every call gets answered in real time. True 24/7 availability means clients working late or dealing with urgent issues always reach a live voice, not an after-hours recording.

→ Client Intake & FAQs

The receptionist (human or AI) answers common questions about your services. "Do you handle business tax planning?" "What are your bookkeeping fees?" They provide basic info like office hours, service lists, and required documents, all from a prepared knowledge base.

→ Detailed Message Taking

For anything that needs follow-up, the service captures name, contact info, and reason for calling in detail. A new tax client? They'll note what type of returns are needed, any deadlines, the urgency level. Everything gets sent to you immediately via text or email.

→ Appointment Scheduling

Many services integrate with Google or Outlook Calendar to book consultations or tax prep sessions on the spot. If a prospect calls wanting a meeting, the receptionist offers available time slots and locks it in. No phone tag required.

→ Smart Call Routing

Good services recognize urgent calls and transfer them per your instructions. Someone mentions "IRS audit" or "fraud alert"? The call goes straight to your cell or an on-call staff member. Less urgent inquiries get logged for next-day follow-up.

→ Spam Filtering

Accounting firms get hammered with spam. Robocallers pitching services. Fake "IRS" scam calls. Quality answering services screen out telemarketers so they don't waste your time. Your line stays free for real clients.

→ Bilingual Support

If your client base includes Spanish speakers, some services offer bilingual receptionists or AI that switches languages seamlessly. Eden's AI receptionist handles English and Spanish fluently, ensuring language barriers don't cost you clients.

The service functions as a virtual front desk for your practice. Some use live human receptionists. Modern solutions like Eden use advanced AI voice technology that sounds remarkably human.

Either way, the goal is the same: make every caller feel heard, helped, and valued.

Why Missed Calls Cost Accounting Firms Money#

You're not sitting by the phone all day. You're deep in client work, audits, deadlines. Here's why missed calls hurt accounting firms so badly:

Tax Season Call Volumes Spike 300-400%#

Between January and April, call volumes for CPAs skyrocket. One study noted a 300-400% jump in calls during tax season. Clients call about last-minute filings, extension requests, refund questions. This surge often comes after hours when clients are off work.

If you rely on a 9-5 receptionist or just voicemail, you simply can't handle the flood.

Why 80% of Callers Won't Leave Voicemail#

Research shows only ~20% of callers bother to leave a message. That means four out of five hang up instead.

And if they hang up, 85% won't call back at all. For an accounting firm, that's disastrous. A business owner calling about a tax issue at 7 PM isn't leaving a message and waiting. They're calling the next CPA on Google.

Voicemail equals a dead end for new business.

How First Responders Win 78% of New Clients#

Studies find 78% of consumers hire the first provider who responds to them. If a prospect calls three accounting firms, the one who answers or returns the call first wins the client.

Also? 76% of people will stop doing business after a single bad experience (like not reaching a human on the phone).

Consistently missing calls signals you're unavailable. That's a reputation no professional can afford.

When Clients Call Outside Business Hours#

Many individuals and small-business owners handle finances outside normal hours. The working parent calls at 8 PM with a bookkeeping question. The startup founder reaches out Sunday about incorporating.

If your firm isn't accessible when they call, they may assume you're too busy or not interested.

What Happens When Urgent Issues Reach Voicemail#

Some client calls simply can't wait. "We just got an IRS notice in the mail, what do we do?" or "My payroll system crashed on Friday night."

If you're unreachable, clients panic or turn elsewhere. An answering service can reassure them ("We've reached your accountant and they will call first thing") or connect urgent issues to you immediately.

That gives clients peace of mind that you have their back, even off-hours.

How Phone Interruptions Kill Billable Hours#

On the flip side, if you try to answer every call yourself, you're constantly interrupted. Studies show lawyers bill only ~2.3 hours of an 8-hour day, with interruptions consuming the rest. Accountants face similar realities during busy season.

Every "quick call" pulls you away from revenue-generating work. An answering service shields you from non-critical interruptions, filtering routine calls and only alerting you for truly urgent matters.

How Spam Calls Waste Time for CPAs#

Accounting firms are magnets for spam. Marketers selling insurance. Office supply pitches. Those notorious "IRS lawsuit" robocalls.

Eden's IntelliSpam filtering blocks known toll-free spam numbers and suspicious calls. Data from law firms shows this reduces nuisance calls by ~90%. Accountants benefit from the same "shield" against junk calls.

Why Professional Image Starts With Your Phone#

Every missed call or impersonal voicemail chips away at your firm's reputation. A client's first impression might be a phone ringing endlessly or an out-of-office message. Not exactly confidence-inspiring when they're trusting you with sensitive financial matters.

Having a friendly, knowledgeable voice answer no matter when people call projects professionalism and reliability. It tells clients, "We're here for you."

For small firms especially, an answering service can make you sound like a larger, well-staffed organization.

Bottom line: As an accountant, your phone ringing is often money calling. One CPA lost a $12,000 client because the person called at 6:30 PM, got voicemail, and immediately went to a competitor who answered. Don't let that happen to you.

Benefits of Answering Services for Accounting Firms#

Setting up a dedicated answering service doesn't just prevent problems. It actively improves your business in multiple ways.

How to Capture Every Lead Around the Clock#

This is the number-one benefit: you never miss out on a potential client due to an unanswered call. The service answers 100% of calls, 24/7/365.

Whether it's a new small-business client needing a CPA, a taxpayer with an urgent question, or a random inquiry from your website, every caller is greeted and helped.

Firms using 24/7 answering services report 30-40% more leads converted from after-hours and overflow calls.

Consider the math: if your average new client (for a tax return or monthly bookkeeping) is worth $500-$1,000 annually, missing even 5 calls a month could mean a $30,000+ annual loss in billings.

An answering service plugs that leak. It acts as an always-on salesperson, capturing and qualifying leads around the clock.

How to Improve Client Satisfaction Scores#

Your existing clients will appreciate it too. With an answering service, clients can reach a live person anytime and get immediate help with routine requests.

They can call to ask "Did you get my documents?" or "When is my filing due?" and get an instant answer if it's in the knowledge base. For complex issues, the service assures them you'll call back and logs their concerns.

This round-the-clock responsiveness makes clients feel cared for. It reduces their anxiety during stressful times (like waiting on a tax refund or dealing with a notice).

A great answering service can even greet repeat callers by name and reference previous conversations. All of this leads to happier clients who stay longer and refer others.

94% of consumers say they're more likely to choose and remain with a business that responds quickly.

How to Fill Your Calendar Without Phone Tag#

For many accountants and tax preparers, your calendar equals revenue. An answering service that can book appointments for you ensures your calendar stays full without you playing scheduler.

When a prospect calls for an initial consultation or a client needs to schedule a tax prep meeting, the service can offer available times (syncing with your actual calendar) and lock it in.

This has two big effects: higher conversion and greater efficiency.

First, capturing the booking at the moment of interest greatly increases the chance the person follows through. Second, it saves your staff time. Eden's AI integrates with Google and Outlook calendars to schedule tax prep sessions in real-time.

That frees up hours of admin work each week. No more phone tag. No double-booking issues.

During tax season rush, on-the-spot booking is a game changer. Your AI receptionist can fill cancellations immediately with the next caller, text scheduling links to undecided prospects, and ensure your capacity is optimally booked with minimal effort.

How to Get 5-10 Hours Back Every Week#

Think about how much time you or your staff currently spend on phone duties:

• Answering basic questions ("Do you take walk-ins?")

• Retrieving voicemails

• Calling people back

• Scheduling meetings

• Filtering spam calls

It adds up quickly and eats into time that could be spent on client work.

By handling the first layer of every call and only involving you when truly needed, a good service can easily give you back 5-10 hours per week of productive time.

Eden's data shows a reduction of 10+ hours of administrative work weekly for users, just from call handling and scheduling automation.

Put another way: if you value your time at $100/hour, and an answering service saves you 10 hours a week, that's $1,000/week of value created. Far above the typical cost of the service.

It's like hiring an assistant at a tiny fraction of the cost.

How to Project a Larger Firm Image#

Even if you're a solo practitioner or a 3-person firm, an answering service can make you appear as polished as a Big Four office.

Every caller hears a confident, courteous receptionist say, "Thank you for calling [Your Firm Name], how may I assist you today?" rather than an automated voicemail.

This instills trust from the get-go. Especially for new prospects, that first call experience is huge. If they reach voicemail, they might question your availability or professionalism. If they reach a live representative who can competently handle their inquiry, it signals reliability.

The personal touch of always having calls answered can differentiate you in a profession where many practitioners still let calls go to VM.

Many answering services will customize scripts to fit your firm's style. You can project whatever image you want (formal and serious, or friendly and approachable). You can include compliance messages (e.g. a privacy disclaimer for recorded calls) to show you take confidentiality seriously.

How to Reduce Stress and Interruptions#

Accounting is already high-stress during deadlines. Add a constantly ringing phone and it's a recipe for burnout.

By entrusting call handling to a service, you and your team can focus on the work at hand without constant interruptions. You'll check messages at designated times instead of being a prisoner to the phone.

This leads to deeper focus, fewer errors (imagine preparing a tax return without 5 phone call pauses), and frankly a saner work environment.

Your staff will thank you too. Often in small firms, junior accountants or admins get roped into phone duty, disrupting their own tasks. Offloading this to professionals means your team can divide and conquer effectively.

Peace of mind is a huge intangible benefit. Many accountants report that just knowing someone is always handling the phones reduces their anxiety significantly, especially around April 15th.

How to Keep Better Call Records#

Most answering services provide call reports and transcripts/recordings. Every call is logged with date, time, caller info, and what was handled.

This creates a useful paper trail for your firm. You can easily search past calls if you need to recall what a client said, or verify that a message was delivered.

Services often email or text you summaries right after each call, so you have instant documentation of every inquiry. No more deciphering scratchy voicemails or losing sticky notes.

Many services also integrate with CRMs or practice management software. Some can input appointment details into systems like QuickBooks or Xero for you.

This means faster follow-up and nothing slips through the cracks. When Monday morning hits, you can review the weekend call log and prioritize easily.

How to Save Compared to Hiring Staff#

Using an external service can be dramatically cheaper than hiring an in-house receptionist. A full-time receptionist's salary plus benefits typically runs $36,000-$41,000 per year (around $3,000/month). In cities or for experienced admin staff, it can be much higher.

By contrast, an answering service costs a few hundred dollars a month at most. Many virtual receptionist plans for small businesses range from $150 to $300 per month.

AI-based services are even more affordable. Most AI receptionist plans cost $25 to $300 per month depending on volume.

Eden's Plus plan is $39/month for 200 minutes, and Pro is $99/month for unlimited calls.

For the price of what you'd pay an employee in one week, you can cover an answering service for an entire year in some cases.

And the service covers evenings, weekends, sick days, vacations without additional cost. To get 24/7 coverage in-house, you'd need multiple staff or an expensive on-call setup.

Just a few saved calls a week will more than cover an AI receptionist's monthly fee.

In summary, an accounting answering service helps you make more money (capture leads), save money (efficient staffing), and deliver better service all at once.

It's rare to find a single solution that tackles both revenue growth and cost reduction, but this is one.

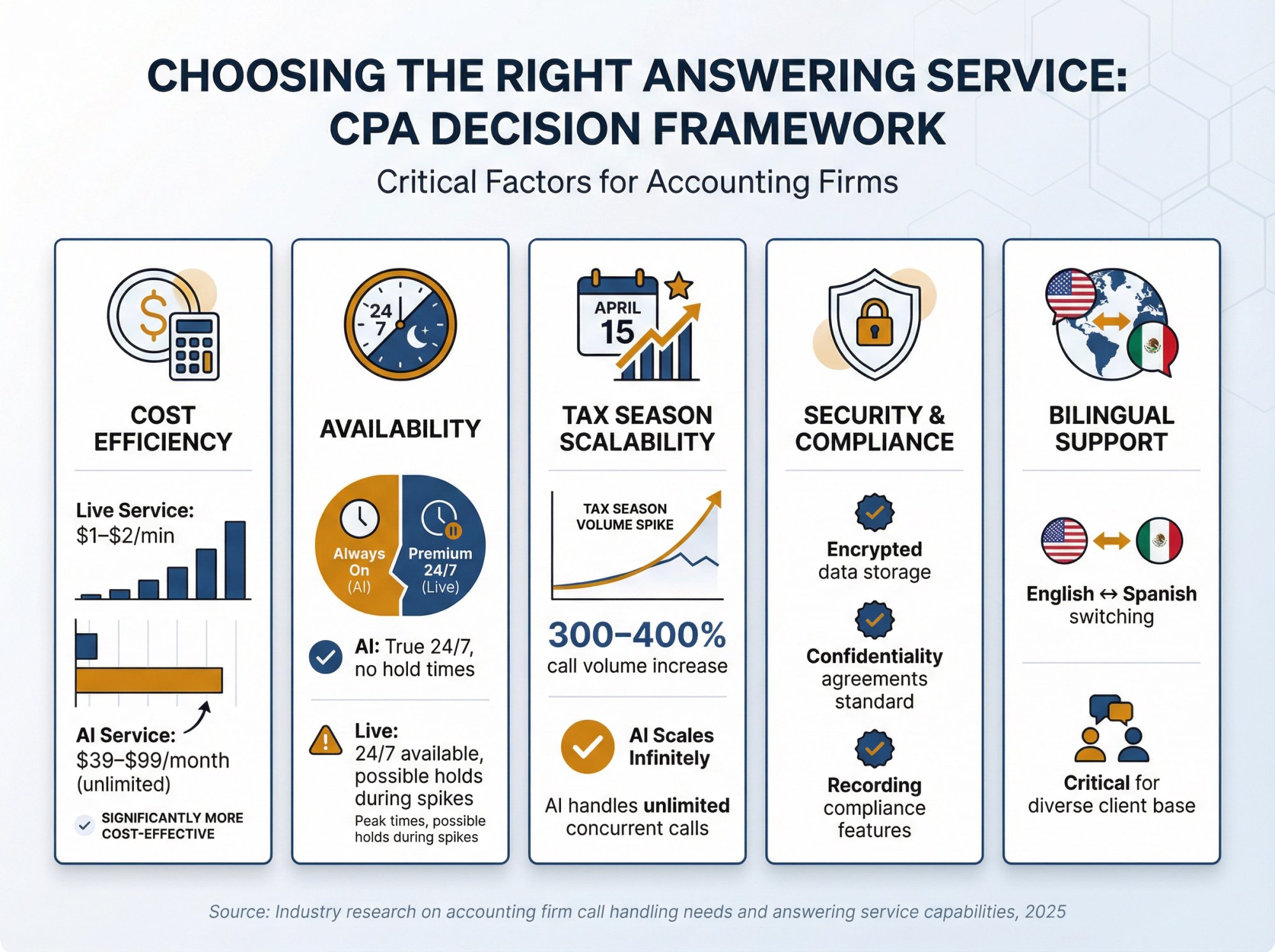

How to Choose an Answering Service for CPAs#

Not all answering services are created equal. The needs of a CPA or bookkeeping firm differ from a medical office or an e-commerce business.

Here are the key factors and features to look for:

Why 24/7 Coverage Is Non-Negotiable#

This is non-negotiable if you want to get the most value. Ensure the service offers round-the-clock answering, every day of the week.

Some cheaper services only cover standard business hours or charge extra for nights and weekends. You want a provider that will answer at 8 PM on April 15th, on New Year's Day, or whenever duty calls, without surprise fees.

Tax emergencies and client inquiries don't follow a schedule. Neither should your answering service.

Also ask about capacity: can they handle multiple calls at once during peak times? An AI service by nature can handle unlimited concurrent calls. A human service should at least have enough staff to cover your busiest spikes.

Why Industry Experience Matters#

Ideally, choose a service with experience in financial or professional services clients. Accounting has its own lingo and common scenarios.

A generic call center might not know what an "EIN" or a "1040 extension" is. Look for clues that the provider understands accounting: do they mention handling tax season calls, or training their agents on financial terms?

Some top live services develop training modules in consultation with CPA firms, so their receptionists recognize phrases like "quarterly estimated payments" or "QuickBooks reconciliation."

An AI service should allow you to upload FAQs and custom info so it can answer industry-specific questions accurately. Eden lets you train the AI on your firm's knowledge base.

For example: Q: "What forms do I need for a small business tax return?" with a tailored answer from your knowledge base.

Make sure whatever service you choose can speak your language.

How to Customize Scripts and Workflows#

Avoid any service that is "one-size-fits-all." Your answering service should follow your specific instructions for different call types.

Key customizations to look for:

① Greeting: You should script the exact welcome greeting ("Thank you for calling Smith & Associates Accounting..."). It should include your firm name and any branding/tone you want.

② Qualifying Questions: You decide what information is collected from callers. For new client inquiries, maybe you want to always ask "How did you hear about us?" or "Are you looking for business or personal services?"

③ Call Routing Rules: The ability to specify how to handle different scenarios. For example: "If the caller says it's an IRS audit or other emergency, attempt to transfer to me or my partner immediately. If unreachable, take a detailed message and mark as urgent."

Eden's AI can recognize phrases like "received an IRS letter" and flag that as urgent.

④ Message Delivery Preferences: You might want messages via text, email, or even directly into a CRM. Good services offer multiple channels.

⑤ Persona and Tone: If using an AI service with voice options, you should be able to pick the voice/persona that fits (e.g. a mature professional tone vs. a bright friendly tone).

The service should let you tailor the experience to your firm's needs. You're aiming for them to effectively become an extension of your team, not a generic call center operator.

What Calendar Integration Features to Expect#

For accounting firms, this is huge. If you want the service to schedule appointments, verify they can integrate with your calendar system (Google Calendar, Outlook/Office 365, Calendly, Acuity).

Two-way integration is best: the service can see your free/busy slots in real time and add appointments directly.

Two-way sync also prevents double-booking.

Ask which calendars they support. Most will at least handle Google and Outlook. Also clarify: can they schedule different appointment types? For example, a 15-minute intro call vs. a 1-hour tax planning meeting.

If you don't want them to book, can they at least schedule a callback for you to contact the person, or put a meeting request on your calendar?

How Messages Should Be Delivered#

The whole point is that you get important info from calls in a timely way. So the service must have rock-solid message delivery.

Look for:

• Instant notifications via email/SMS after each call

• A web portal or app where you can review all messages and call recordings

• Possible integration to log calls in your CRM or practice management system

Speed is important. You don't want to wait an hour for an email with a new lead's info. The best services send summaries within minutes of the call ending.

Many also provide the full transcript or audio recording for you to review if needed. Eden emails a complete call transcript and action items immediately, and shows all calls in a real-time dashboard.

Test this during a trial: call your number and leave a test scenario, then see how quickly and accurately the message comes through.

What Security Features to Require#

As an accounting firm, you deal with sensitive financial information. While HIPAA might not apply, clients still expect confidentiality.

Ensure the service has proper security measures:

→ Secure data handling: Messages and call recordings should be stored securely (encrypted databases, etc.). If receptionists need to take down SSNs or credit card numbers, ask how that data is protected.

→ Confidentiality agreements: Reputable answering services have confidentiality clauses and will sign NDAs if you require.

→ Call recording compliance: Recordings are great for quality assurance, but you may need to disclose to callers. Some AI receptionists will automatically play a brief disclaimer ("This call may be recorded for quality purposes") if required.

Make sure you can enable/disable or customize such compliance messages to align with your local regulations.

When Bilingual Support Is Essential#

Do a significant number of your clients speak Spanish or another language? If so, prioritize a service with bilingual capabilities.

Many leading services have English/Spanish fluency as a standard offering. One provider noted that 45% of construction-related calls were bilingual. In accounting the percentage might be lower but still impactful in diverse areas.

If using a live service, ask if they have bilingual receptionists available at all times. If using an AI service, check which languages the AI supports.

Eden's AI can seamlessly switch between English and Spanish mid-call, which is a big plus if you have a mix of clients.

The ability to say "Sí, hablamos Español, un momento por favor..." can win you clients that otherwise might seek out a Spanish-speaking firm.

How to Verify Reliability and Reputation#

You're trusting this service with your customer's first impressions and critical messages, so they must be dependable.

Research the provider's reputation. Read case studies or testimonials from other professional service firms. Look for metrics like their call answer rate (e.g. "97% of calls answered within 3 rings"), their uptime (many advertise 99%+), and how long they've been in business.

If possible, do a trial run. Most services offer a free trial or month-to-month plans. Test how they handle your calls over a couple of weeks during both peak and quiet times.

Pay attention to call quality (any complaints from clients about hold times or rudeness?), accuracy of messages, and the general ease of use of their portal.

The Voice Test Every Firm Should Do#

This one is important: Actually call in and experience what your customers will hear. Many providers will give you a demo number to call, or during your trial you can simply ring your own number from a different phone.

Evaluate the experience:

• Is the voice (human or AI) clear, friendly, and professional?

• Do they pronounce your firm name correctly?

• Are they following your script and instructions accurately?

• If it's an AI, did you immediately recognize it as a robot or did it sound natural?

Trust your gut. If something sounds off to you, it will to your clients as well.

Modern AI voice actors can be remarkably human-like. Have colleagues or friends call and give you feedback too.

Don't hesitate to request adjustments. The goal is to ensure the caller's experience feels like they're dealing with your firm directly.

AI vs Live Answering Services: Which Wins for Accountants?#

Today you have a choice between old-school live answering services (human receptionists in a call center) and cutting-edge AI virtual receptionists.

Both can handle calls for an accounting firm, but they come with different strengths and trade-offs.

| Aspect | Live Human Service | AI Virtual Receptionist |

|---|---|---|

| Cost | $1.00-$2.00 per minute (typically $150-$600+ per month). Overage fees $1+ per min. | Flat rates, e.g. $39-$99/month for SMB plans (often unlimited or high minute count). Overage $0.20/min in some cases. |

| Availability | Can be 24/7 if you pay for a premium plan. Some hold times during spikes. | True 24/7/365 coverage. No hold times. Answers immediately, can take multiple calls at once. |

| Consistency | Varies by agent. Humans can be excellent, but can also have off days. Only one call at a time per agent. | Highly consistent. Follows the script every time, never "has a bad day." Can handle many calls simultaneously with identical quality. |

| Personal Touch | Genuine empathy and conversational nuance from a skilled receptionist. Some callers may feel more comfortable with a human. | Natural-sounding but simulated warmth. Modern AI voices are very good, and many callers don't realize it's AI. |

| Knowledge Depth | Depends on training. Human agents handle multiple clients; they might only have basic info about your firm. | AI can be loaded with all your FAQs, services, pricing, policies. It can reference your website or knowledge base to answer many questions on the spot. It never "forgets" info. |

| Scalability | Limited. To handle more volume, the service needs enough staff available; quality can dip if overwhelmed. | Infinitely scalable. Got 100 calls at once? The AI can handle them. |

| Speed | A live agent works at human speed. Might put callers on hold to look up info. | Immediate responses. The AI processes queries in milliseconds. Overall shorter call handle times for simple tasks. |

| Best For | Firms who highly value a human touch for every caller, and are willing to pay for it. | Cost-conscious firms who want maximum coverage for minimum cost. Ideal for high call volumes, after-hours coverage, and handling routine calls. |

When Live Receptionists Make Sense#

Pros:

Human warmth and understanding. A well-trained human receptionist can build rapport, detect a caller's tone, and show empathy. If a frantic client calls saying "I'm being audited and I'm really scared," a human can naturally reassure them.

Complex call handling. If a prospective client starts giving a long story about their business situation, a human can patiently listen, parse what's needed, and interject appropriately.

Preferred by some callers. A segment of customers simply prefer interacting with a person. This might include some older clients or those skeptical of technology.

Cons:

Cost adds up. As shown, $1-$2 per minute is common. A single lengthy call can eat 10 minutes = $15 of cost. If you have dozens of calls a week, you could end up paying $300, $500 or way more monthly.

Inconsistency and errors. People make mistakes. They might transpose a phone number in a message. With multiple agents answering for your firm, each one might handle calls slightly differently. Also, humans can only do one call at a time. If two clients call at the same moment, the second might get voicemail or be placed on hold.

Training & knowledge limits. Unless the service assigns a dedicated team that you personally train, most live receptionists work from a brief script about your firm. They likely won't answer detailed questions. They may also not catch nuances.

Availability issues. Even if a service promises 24/7, humans can get overwhelmed or have outages. With AI cloud services, as long as the platform is up, you're covered every day.

When AI Receptionists Excel#

Pros:

Dramatically lower cost. AI services tend to charge flat monthly rates. No per-minute fees in many cases. Eden's Pro plan at $99 for unlimited minutes means you can handle hundreds of calls for the same price that a live service might charge for 50-100 calls.

Over a year, choosing AI over human can save thousands of dollars.

24/7 flawless coverage. The AI will never call in sick, never get tired, never let a call ring past the first ring. At 3:00 AM, it's as alert as at 3:00 PM. During peak times, if 5 people call at once, all 5 get answered instantly.

Deep business knowledge. You can essentially upload your brain to the AI. The best AI receptionists ingest your website content, FAQs, service descriptions, even past Q&A. When a caller asks, "What's your hourly rate for bookkeeping?" or "Do you handle multi-state tax filings?", the AI can answer accurately.

Eden's AI is like having a receptionist who memorized your entire website and pricing sheet.

No wait and quick resolutions. For straightforward interactions, AI is blazing fast. It can schedule an appointment in seconds. The overall call length can be shorter for simple tasks.

Continuous improvement. AI services improve over time. Providers train their models with more data. You can tweak it by reviewing transcripts. After the first month, it only gets better each month.

Integration and automation. AI can hook into other systems easily. It could trigger a Zapier workflow to add a new lead to your CRM after a call, or send a WhatsApp message.

Cons:

Lack of human nuance. If a caller goes really off-script or has an emotional meltdown, the AI might handle it in a somewhat robotic way. A good AI is programmed to escalate to a human (you or your staff) as soon as it detects distress or complexity.

Caller awareness. Some callers will recognize they're speaking to an AI. A few might react negatively ("Oh, it's a robot..."). This is becoming less common as people get used to virtual agents (and as the tech improves).

Setup and tweaking. An AI receptionist requires configuration. While it's often straightforward (Eden can pull info from your website automatically), you still need to review and possibly add missing details.

No human option (unless hybrid). Pure AI services won't have a human on standby if the AI gets confused. They'll instead take a message or try a transfer to you.

Which Option Saves More Money?#

For most small firms, AI receptionists offer the best blend of cost and capability. They shine in handling the routine 90% of calls at low cost.

You'll capture all those missed calls and basic inquiries perfectly. For the rare call that truly needs a human touch, you can design your call flow so that those get flagged for you or a staff member to handle personally.

This hybrid approach works beautifully:

AI handles initial intake → You handle complex follow-up → Both efficiency and personal service delivered

To illustrate the cost difference: 300 minutes of calls (which could be 100+ calls in a month) would cost around $450 with a human service, but only $99 with an AI unlimited plan.

That savings (~$350) in one month likely exceeds what you'd lose if one or two callers were slightly put off by AI.

The "best" answering service is the one that reliably solves your missed call problem, stays within your budget, and aligns with your client service philosophy. For many modern accounting firms, that's an AI solution.

Best Answering Services for Accountants (2025)#

There are dozens of services out there, but a handful stand out. Here's a quick rundown of leading options:

Eden AI Receptionist#

An AI-driven answering service built specifically for small businesses.

Best for: Solo and small firms who want an affordable, industry-tailored solution.

Why Eden: It comes pre-trained on many accounting scenarios (tax season calls, bookkeeping FAQs) and offers advanced features like intelligent call transfers based on keywords (e.g., mention of "IRS audit" triggers emergency routing).

Eden also boasts IntelliSpam filtering (blocks known spam numbers) and deep customization of the AI's persona.

Price: Plus plan $39.99/mo (200 min) and Pro $99/mo (unlimited).

Standout feature: ~90% spam blocking which reportedly saves ~15 hours/month for users by cutting junk calls.

Eden offers a 7-day free trial as well.

Traditional Live Services#

Several established providers offer human receptionist services for accounting firms. These typically charge per-minute rates and offer professional training for agents who understand accounting terminology.

Best for: Firms that want a hybrid approach or prefer human interaction.

Price: Most traditional live services range from $150-$700 per month depending on volume and features.

Considerations: Higher cost, potential for inconsistency, and limited scalability during peak seasons.

When comparing, consider doing free trials back-to-back. Try Eden's AI for a week (since it's quick to set up), then maybe trial a live service the following week.

See which one captures more info, which your callers seemed to respond to better, and what fits your workflow.

How to Set Up an Answering Service Step by Step#

Once you pick a service, getting started is usually quick:

1. Sign Up and Onboard

You'll fill out a profile about your firm (address, website, the greeting you want, FAQs/answers, specific instructions). For live services, this is what operators will reference. For AI, this feeds the AI's brain.

Many AI systems, like Eden, will also crawl your website to extract info automatically, which accelerates setup.

2. Number Setup

Decide whether to forward your existing phone number or get a new number from the service.

Most businesses keep their current number and set up conditional call forwarding. For example, all calls that you don't pick up in 3 rings, or all calls after hours, will forward to the service.

The service will provide instructions for your phone provider. It's usually as simple as dialing a star code on your phone (*72 or *92 etc., depending on your carrier).

Eden provides a detailed forwarding guide for each major carrier in its dashboard (RingCentral, Google Voice, Verizon, AT&T, etc.).

3. Testing

Do a few test calls from different lines. Call after hours, call with a Spanish inquiry if applicable, pretend to be a new client vs. an existing client.

This is your chance to adjust the script or settings before real clients start calling.

4. Go Live & Monitor

Once you're comfortable, start directing client calls in earnest. Keep an eye on the first couple of weeks of transcripts/messages.

If anything is off (maybe the AI misinterpreted a question or a live receptionist missed asking something), provide that feedback sooner than later so it can be fixed.

5. Inform Clients (Optional)

You're not obligated to tell clients you're using a service, but it doesn't hurt to mention that "we have a 24/7 reception team/assistant now, so someone is always available to take your call."

In most cases, clients will just be happy someone answered.

6. Enjoy Peace of Mind

Going forward, you can work without worrying about the constantly ringing phone. Check your messages at intervals, return the truly important calls, and watch your conversion rate of callers-to-clients improve.

The first time you get a new client who says "I chose you because your assistant was so helpful when I called," you'll know it's working.

Data to watch: Many services provide analytics. Eden's dashboard might show you had 50 calls last week, of which 20 were after hours and 15 were spam blocked.

Imagine how many of those 35 real calls you might have missed previously. Use these stats to gauge ROI.

Answering Service FAQs for Accounting Firms#

What is an accounting answering service and how does it work?#

An accounting answering service is a professional call-handling solution specifically designed for CPA firms, tax preparers, and bookkeepers. It works by answering all incoming calls to your firm 24/7, greeting callers in your company name, and handling their needs through a combination of live agents or AI technology.

The service can answer common questions about your services, take detailed messages, schedule appointments directly into your calendar, and transfer urgent calls to you when needed.

How much does an answering service for accountants cost?#

Costs vary widely depending on whether you choose a live human service or AI-based solution:

• Live human services typically charge $1-$2 per minute, resulting in monthly costs of $150-$600+ for small firms

• AI answering services usually offer flat monthly rates of $25-$300, with many unlimited call options

Eden's pricing starts at $39/month for 200 minutes on the Plus plan, and $99/month for unlimited calls on the Pro plan, making it significantly more affordable than hiring an in-house receptionist or using traditional live services.

Can an answering service schedule appointments for my accounting firm?#

Yes, many modern answering services can schedule appointments directly into your calendar. The best services integrate with Google Calendar and Outlook, allowing them to see your available time slots in real-time and book consultations, tax prep sessions, or follow-up meetings on the spot.

Eden's AI integrates seamlessly with major calendar platforms, eliminating phone tag and ensuring your calendar stays full during busy seasons.

Will my clients know they're talking to an answering service?#

With live answering services, clients typically don't realize they're speaking to an external receptionist, as agents answer using your firm name and follow your custom script.

With AI services, the experience depends on the quality of the technology. Modern AI receptionists sound remarkably human, and many callers don't realize they're speaking with AI. The key is choosing a service with high-quality voice technology and proper customization.

How does an answering service handle sensitive financial information?#

Reputable answering services have strict security measures in place, including encrypted data storage, confidentiality agreements, and secure message delivery systems. While they're not typically HIPAA-compliant (that's for healthcare), they do protect client information.

When selecting a service, ask about their security protocols, whether they'll sign an NDA, and how they handle sensitive data like SSNs or credit card numbers. Many services can be configured to avoid collecting extremely sensitive information over the phone.

Can answering services handle bilingual calls for accounting firms?#

Yes, many answering services offer bilingual support, particularly English and Spanish. Eden's AI receptionist can seamlessly switch between English and Spanish mid-call, ensuring you don't lose clients due to language barriers.

This is especially valuable in diverse communities where potential clients may prefer to communicate in their native language.

How do answering services filter spam calls?#

Advanced answering services include spam filtering features that automatically identify and block robocalls, telemarketers, and scam calls. Eden's IntelliSpam filtering can block known toll-free spam numbers and suspicious calls automatically.

This spam blocking reportedly saves firms ~15 hours per month by eliminating time wasted on junk calls, allowing your paid minutes to go toward real client conversations.

What happens during tax season when call volume spikes?#

This is where answering services really shine. Unlike in-house staff who can get overwhelmed, AI services can handle unlimited concurrent calls without any degradation in quality or increase in cost.

Live services may have capacity limits, so it's important to confirm they can handle your peak volume. Eden's AI can answer multiple calls simultaneously during those critical weeks in March and April when every missed call could be a lost client.

Can I customize how the answering service handles different types of calls?#

Absolutely. Quality answering services allow extensive customization including custom greetings, specific qualifying questions, call routing rules based on keywords or urgency, and personalized message delivery preferences.

Eden lets you configure custom workflows, so urgent matters (like "IRS audit" mentions) trigger immediate transfers while routine inquiries are logged for follow-up.

How quickly can I set up an answering service for my firm?#

Setup times vary by provider, but modern AI services can often be operational within hours. You'll need to provide basic firm information, upload your FAQs, set your preferences, and configure call forwarding.

Many AI systems like Eden can automatically pull information from your website, significantly speeding up the process. Live services may take a few days to train agents on your specific needs.

Most services offer free trials, allowing you to test everything before committing.

Stop Missing Calls and Start Growing Your Practice#

For accounting and tax firms, an answering service is more than a convenience. It's a revenue safeguard and a client experience upgrade.

The days of relying on voicemail are over. As we've seen, the majority of callers won't leave a voicemail, and won't call back. If you're still letting calls slip by, you could be losing tens of thousands of dollars a year in work.

Solutions like Eden are readily available, easy to set up, and affordable even for solo practitioners. They ensure every call gets answered and every caller gets care, without requiring you to hire staff or burn yourself out being on-call 24/7.

Whether it's capturing a new client lead at 7 AM, booking a last-minute appointment for a procrastinating taxpayer, or filtering 10 spam calls a day so you can work in peace, an answering service has your back.

In a profession built on trust and responsiveness, this is one investment that can set you apart. Clients will appreciate the always-there availability, and you'll appreciate the freedom and growth it brings.

It's not often you find a tool that simultaneously increases revenue, improves client satisfaction, and reduces your workload. But that's exactly what a great answering service delivers.

So ask yourself: How much longer can I afford to miss calls?

Every ring could be a new client or a crucial question from an existing one. With an accounting answering service in place, you can confidently say "no call will go unanswered."

Ready to never miss another client call (or tax season lead)? Eden's AI Receptionist can be up and running for your firm in minutes. You can start a free 7-day trial with no credit card and see how it handles your calls.

Experience the difference of having a 24/7 professional assistant for your practice, and join the growing number of accountants who are turning phone calls from a headache into a competitive advantage.

Ready to Transform YourCustomer Experience?

Join hundreds of businesses using Eden AI to handle calls, book appointments, and provide 24/7 customer support.